Are your Letterheads Legal?

Listed Under: Blog

When designing your company letterhead and order form you could be forgiven for solely concentrating on their design and the quality of paper they are printed on.

When designing your company letterhead and order form you could be forgiven for solely concentrating on their design and the quality of paper they are printed on.

However, your company letterhead and order form need to follow several legal requirements. If you fail to implement these then hard work and vital cash will have been wasted.

Thankfully the requirements are simple. They also vary by the type of business run.

Sole trader business letterhead guidelines

If you are a sole trader you can trade under your own name or you can choose a different business name. If you choose a business name that is not your own name, you must include your own name and the business address on all letterheads and order forms.

Partnership business letterhead guidelines

If you are a partnership business your letterheads, order forms, receipts and even invoices must include the names of all partners and the address of the main office. If there are many partners then it is also acceptable to state where a list of partners may be found.

Limited company letterhead guidelines

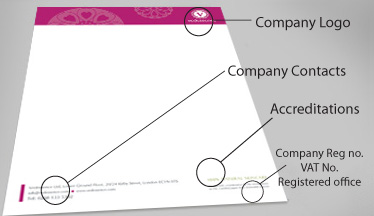

If your company is trading as a limited company the letterhead and order form stationery (whether printed or electronic versions) must include:

- Your full registered company name

- The company registration number and place of registration

- The company registered address and the address of its place of business, if different

- There is no need to include the names of the directors on the letterhead for a limited company, but if you choose to name directors all directors must be named

Most letterheads also include a telephone and fax number, a url for the business’ website and an email address.

Certain businesses must also state the following on their business letters and order forms:

For an investment company (as defined by section 266 of the Companies Act 1985) that it is such a company.

For a company exempt from using the word ‘limited’ in its name, that it is a limited company

For a company with share capital, it is not necessary to state the share capital on stationery but if the company chooses to do so, the paid-up share capital rather than the authorised capital must be stated.

Charitable companies whose name excludes the words ‘charity’ or ‘charitable’ must state the fact that it is a charity on its stationery.

loading...

loading...